The crackle of early morning emails, a hot cup of kopi in hand, and scrolling through stories of breakthrough innovations — this is the usual digital ritual for many who watch the financial world spin, especially in Asia.

But what really sets my mind racing these days isn’t just the steady hum of fintech news. Nah, it’s how fast Asia’s financial technology scene is exploding into a giant, interconnected ecosystem, rewriting the way money moves, grows, and serves millions.

The kind of transformation that doesn’t just happen in boardrooms or on Wall Street—it’s felt in the palm of your hand, on your daily commute, in your small town or mega city.

Asia is no stranger to the Fintech Revolution; heck, it’s become the pulsating heart of it. Companies like Ant Group, Grab, and ADDX are pushing boundaries, the Monetary Authority of Singapore (MAS) and Hong Kong Monetary Authority are pioneering regulatory innovations, and startups from Jakarta to Tokyo are hustling hard to redefine financial inclusion.

This article isn’t just about numbers and stats — it’s about why this unstoppable rise of financial technology in Asia is a story about empowerment, innovation, and a dash of that relentless entrepreneurial spirit.

The Unfolding Fintech Revolution: More Than Just Buzzwords

When we talk about Financial Technology (Fintech) in Asia, it’s easy to get lost in jargon like blockchain, digital wallets, and cryptocurrency.

But beneath these terms lies a reality that millions live daily: easier access to banking, quicker loans, safer transactions, and opportunities for wealth management that once felt reserved for the elite.

Asia’s fintech market reached a staggering $200 billion in 2022, with predictions to double by 2025. That’s not just growth — that’s a tsunami reshaping the landscape.

The proliferation of mobile payments—where transaction volumes rocketed from a mere $10 billion in 2010 to an eye-popping $1,780 billion in 2022—tells a vivid tale.

And who better to credit than users in countries like China, India, and Indonesia, where smartphone penetration has made digital financial services almost second nature.

But wait, here’s the kicker—this rise isn’t just about tech. It’s about people. The unbanked and underbanked populations, especially in rural Asia, are finally stepping into the light of financial inclusion, armed with nothing but their phones and the promise of a better financial future.

The Role of Asian Fintech Giants & Innovators

You can’t talk about Asia’s fintech scene without name-dropping a few legends. Ant Group, for example, led by the sharp strategist Peng Wensheng, revolutionized digital payments with Alipay, becoming synonymous with cashless payments across China and beyond.

But Ant Group is more than just payments—they’re pioneering blockchain for transaction verification and experimenting with digital identity systems.

Then you have Grab, co-founded by Anthony Tan, morphing from a ride-hailing app into a super app ecosystem that blends mobile payments, digital lending, and even insurance. It’s a masterclass in how financial services can merge with everyday life.

The Monetary Authority of Singapore (MAS) deserves its own spotlight too. They aren’t just regulators; they’re enablers of fintech innovation.

Their regulatory sandbox and API hubs create safe spaces for startups to test bold ideas without fear of getting shut down overnight. It’s no surprise Singapore is the Asia-Pacific fintech hub.

Even in places like Thailand and Vietnam, firms like SiriHub and MoMo are rewriting the rulebook on digital lending platforms and cross-border payments, making remittances faster and cheaper for millions of migrant workers.

How COVID-19 Supercharged Asia’s Fintech Adoption

If fintech growth in Asia was a speeding train, COVID-19 was the powerful push that sent it barreling forward at an insane pace. The pandemic forced millions to rethink how they handle money—no more cash, no more queues at bank branches.

From 2020 to 2021 alone, digital banking registrations spiked by 67%, while cash transactions plunged by 52%. Seniors, who once hesitated to embrace digital finance, saw an 89% increase in first-time users of digital financial services.

One story that stuck with me was from a village elder in Vietnam. She told a reporter how her grandson helped her set up a digital wallet on MoMo, allowing her to receive pensions and pay bills without leaving her home—a tiny change, but a giant leap in independence.

Across Asia, fintech isn’t just a tool; it’s a lifeline. Companies like Silent Eight in Singapore are using AI-powered fraud detection to secure millions of transactions daily, while banks like DBS Bank have slashed operating costs by 80% through cloud infrastructure transformations, reinvesting those savings into customer experience.

| Keyword/Topic | Explanation |

|---|---|

| COVID-19 Impact on Fintech | The pandemic accelerated digital payments and financial services adoption across Asia. |

| Asia’s Fintech Growth | Asia saw rapid growth in fintech use due to lockdowns and increased demand for contactless payments. |

| Digital Payments Adoption | Consumers and businesses shifted to digital wallets and online banking for safety and convenience. |

| Financial Inclusion | Fintech helped expand financial access to unbanked populations during COVID-19. |

| Remote Financial Services | Remote onboarding and mobile banking became essential during social distancing measures. |

| Regulatory Support | Governments eased regulations to support fintech innovation and rapid deployment. |

| Consumer Behavior Change | The crisis changed consumer preferences toward faster, safer, and more convenient financial solutions. |

| Fintech Innovation | New products and services emerged quickly to address pandemic-related financial challenges. |

| Future of Fintech in Asia | COVID-19 set the stage for sustained fintech growth and transformation in the region. |

Breaking Down Asia’s Fintech Landscape: The Sectors Powering Growth

Mobile Payments & Contactless Systems: The New Currency

You gotta admit, waving your phone over a terminal is just plain cool. But behind that simple action is a complex web of payment platforms, from WeChat Pay in China to GoPay and Akulaku in Indonesia, not to mention the widespread use of Octopus cards in Hong Kong.

These systems are driving the shift towards cashless payments, reducing friction and expanding financial access in urban and rural areas alike.

Digital Lending & Credit Scoring: Opening Doors to the Unbanked

Traditional banks used to shy away from lending to small entrepreneurs or gig workers without credit histories. Enter CreditVidya in India and Kredivo in Indonesia, using AI credit assessment and alternative data to extend credit where it’s desperately needed.

The result? A flourishing of micro-businesses and personal financial empowerment, backed by innovative digital lending platforms that prioritize speed and convenience.

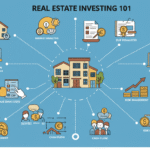

Wealth Management & Investment Tech: Democratizing Finance

No longer the preserve of the wealthy, platforms like Seedly in Singapore and Planto in Hong Kong are bringing personalized financial management to millennials and Gen Z alike.

With robo-advisors, micro-investing, and tokenized assets, the dream of accessible wealth building is becoming reality for many.

Blockchain & Cross-border Trade Finance: The Future of Global Transactions

One of the toughest nuts to crack in finance is cross-border transactions. But with startups like Contour and Airwallex pioneering blockchain solutions for trade finance, Asia is shaping the future of cross-border payments, making transactions faster, cheaper, and more transparent.

RegTech & Compliance Innovation: Navigating Complex Waters

The rise of fintech means new risks. Enter RegTech players like Tookitaki and Compliance-as-a-Service platforms that help firms stay on the right side of evolving regulations, ensuring trust in the system and protecting consumers from fraud and money laundering.

Cultural Nuances: Celebrating Fintech’s Impact Across Asia

What’s striking about Asia’s fintech rise isn’t just its scale—it’s how deeply it respects and reflects local cultures. In India, platforms incorporate local languages and vernacular, enabling millions to navigate financial products in their mother tongues.

In Japan and South Korea, fintech firms blend technology with cultural emphasis on privacy and security, leveraging biometric authentication like facial recognition and voice recognition to protect users.

In Southeast Asia, fintech companies often partner with local governments and organizations, such as GovTech (Singapore), to ensure technologies reach underserved communities, including women and rural populations traditionally excluded from banking.

Dr. Lin Mei, an AI Research Lead featured in FTasiaFinance, remarked, “Asia’s fintech growth is not just a tech story; it’s a social revolution powered by diverse voices and needs.”

The Road Ahead: Challenges and Opportunities

Of course, no story about fintech’s rise is complete without acknowledging bumps in the road. Data privacy concerns, regulatory uncertainties, and legacy infrastructure pose hurdles. But Asian fintech players are nimble.

For instance, the adoption of cloud-native fintech architecture by banks like DBS and the use of edge computing are boosting security and speed, while governments across Asia experiment with digital identity verification and regulatory sandboxes to foster innovation while protecting consumers.

The growth of venture capital in fintech across Asia signals confidence, with both early-stage startups and late-stage firms attracting billions in investments.

Countries like Vietnam saw fintech investment grow by over 215% between 2019 and 2022, while Indonesia, with its massive population of 270 million, remains a hotspot for emerging fintech markets.

Conclusion

The unstoppable rise of financial technology in Asia is a story of visionaries, disruptors, regulators, and everyday people, all connected by a shared desire for better, faster, and more inclusive financial services.

It’s about transforming dreams into real opportunities, from the buzzing streets of Shanghai to the villages of Cambodia.

If you’re looking to dive into this vibrant world, remember: fintech isn’t just about the tech. It’s about the people it serves. Whether you’re a startup founder, investor, or simply a curious user, the key to thriving in Asia’s fintech revolution is staying adaptable, empathetic, and open to the endless possibilities digital finance brings.

Freqeuntly Asked Questions

stock trend

Stock trend refers to the general direction in which a stock’s price moves over a period, indicating bullish or bearish market behavior.

models of forecasting

Models of forecasting are systematic methods used to predict future data based on historical trends and statistical techniques.

forecast modeling

Forecast modeling involves creating mathematical or computational models to estimate future outcomes using relevant data inputs.

forecasting models

Forecasting models are tools or frameworks designed to analyze past data and predict future events, such as sales or stock prices.

forecasting model

A forecasting model is a specific algorithm or technique applied to generate predictions for business or economic variables.