Diving into real estate feels kinda like stepping into a whole new world, doesn’t it? Like suddenly you’re not just someone paying rent or dreaming of a house — you’re a potential wealth-builder, a strategist, a captain navigating the stormy seas of market trends and property values.

If you’ve ever wondered how to invest in real estate with no money or thought real estate was only for the ultra-rich, buckle up. We’re gonna flip those ideas on their heads, talk about some wild and real ways to get started, and demystify this whole journey — step by step.

Let me share a lil secret: real estate is not just about buying and selling buildings. It’s about crafting your own path to financial freedom and building something that lasts longer than any stock ticker or fancy crypto coin.

But like any great adventure, there’s a bit of a roadmap needed — and that’s exactly what you’ll get here. No boring jargon, no cookie-cutter advice, just real talk, practical tips, and inspiration to kickstart your real estate investing for beginners with no money.

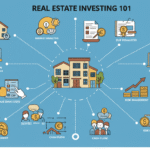

Understanding Real Estate Basics for Beginners

First thing’s first, let’s break down some real estate basics for beginners that often get overlooked. Real estate ain’t just houses and apartments — it’s a universe of options:

- Residential real estate: Single-family homes, condos, duplexes — the kind of properties people live in.

- Commercial real estate: Offices, retail shops, warehouses — spaces where businesses thrive.

- Industrial real estate: Think factories, logistics centers, distribution hubs.

- Land investments: Empty plots that might someday become a neighborhood or a shopping mall.

Each one of these has its own rhythm, its own market dynamics and risks. For example, rental properties bring steady rental income but require landlord skills like handling tenant turnover and maintenance.

Meanwhile, house flipping can offer fast investment returns but comes with a rollercoaster of work and risk.

If you’re wondering how to dip your toes without the big bucks, consider exploring real estate investment trusts (REITs) — they’re kinda like mutual funds but for real estate.

You get to invest in portfolios of properties without buying the actual physical stuff, and it’s a great way to get familiar with the market without a big down payment.

How to Invest in Real Estate for Passive Income

Passive income, the holy grail of many investors, is more attainable than you might think. The trick is knowing where to start and how to avoid the traps.

- Rental properties are the classic example — buy a property, rent it out, and collect monthly payments. But here’s the kicker: managing tenants and maintenance can be a full-time job unless you hire someone.

- House hacking is a clever move where you live in one part of a property and rent out the rest — think duplexes or triplexes. It cuts your living expenses dramatically.

- Another less-known but increasingly popular path is real estate crowdfunding through a real estate investing app — you pool money with others and invest in bigger projects.

- If you don’t have cash for a down payment, learning how to invest in real estate with no money might mean tapping into alternative financing options like hard money loans, private money loans, or even syndicate equity financing.

One piece of advice from a seasoned investor I once met? “Don’t wait for perfect credit or a fat bank account. Start learning, networking, and thinking creatively about financing.”

Read This Blog: https://blessloom.com/executive-coaching-program/

Real Estate Investment Examples That Inspire

Stories stick better than theory, right? Here’s a handful of real-life real estate investment examples that might light a fire under your ambitions:

- Sarah, a teacher from Ohio, bought a rundown duplex using a small down payment from her savings and a traditional mortgage. She lived in one unit and rented the other, turning her living expenses into an investment. Five years later, she’s got enough equity to buy a second property.

- Mark, an entrepreneur, got into house flipping. He found a neglected home, renovated it on a tight budget, and sold it for a profit within six months. His secret? Networking with contractors who offered flexible payments.

- Emily discovered real estate crowdfunding platforms and started investing with as little as $500. Now, she owns fractional shares in commercial buildings and enjoys quarterly dividends.

- Another cool example is a group of friends pooling resources to buy a small strip mall using syndicate equity financing, sharing risks and profits equally.

These stories show there’s no one-size-fits-all path. The common thread? Each investor leveraged what they had — be it knowledge, connections, or a modest sum — to get started.

Navigating Financing: From Credit Scores to Commercial Loans

Money talk is the tough part but knowing the landscape helps you avoid nasty surprises. Here’s a quick glance:

- Your credit score hugely impacts your chances of loan approval and interest rates. But don’t be disheartened if your score isn’t perfect — there are financing options outside traditional banks.

- Traditional mortgages usually require good credit and down payments, but programs for first-time buyers or investors can help.

- Hard money loans are short-term, high-interest loans from private investors, useful for quick deals or flips.

- Private money loans come from individuals and may offer more flexibility.

- For commercial real estate, you might explore commercial loans or even sale-leaseback transactions where businesses sell their property and lease it back, freeing capital.

- Equity in current properties can sometimes be leveraged for new investments — a powerful tool if managed wisely.

Don’t underestimate the value of building a solid relationship with local lenders or attending networking events — real estate investing is as much about connections as it is about capital.

Portfolio Diversification: Why Real Estate Is Your Ally

If your portfolio’s a garden, real estate is the towering oak that provides shade and shelter in storms. Why?

- Real estate generally has a low correlation with stocks and bonds, helping to smooth out market volatility.

- It’s a fantastic inflation hedge — as prices rise, property values and rents usually follow.

- The ability to use leverage (borrowed money) lets you magnify your returns.

- Real estate offers unique tax benefits like deductions on mortgage interest, depreciation, and property taxes.

Think about diversifying into different property types — from residential to industrial real estate — and different locations, especially growth areas identified through thorough market research. That way, you’re not putting all your eggs in one basket.

Real Estate Investment Challenges and How to Tackle Them

No adventure worth having comes without hurdles. Real estate investing involves risks like:

- Market downturns impacting property appreciation and investment returns.

- Tenant issues, including vacancies and damages.

- Unexpected maintenance and repair costs.

- Navigating complex local regulations and real estate taxes.

- Managing lease terms and tenant relationship management.

But here’s where good planning comes in: thorough market analysis, having a cash reserve, and knowing when to hold or fold are key. As one landlord put it, “You gotta expect some storms but build your ship strong.”

How to Start Your Real Estate Investing Journey Today

So, you’re ready to jump in? Here’s a quick starter pack:

- Educate yourself — use books, podcasts, and apps designed for real estate investing for beginners with no money.

- Begin with what you know: maybe it’s a small rental or even investing in a REIT.

- Network with local investors, realtors, and lenders.

- Check out real estate investing apps for crowdfunding opportunities.

- Experiment with house hacking or wholesaling to get your feet wet.

- Keep an eye on market trends, economic conditions, and infrastructure developments in your area.

Conclusion: Making Real Estate Your Gateway to Financial Freedom

Real estate isn’t some magical, unreachable fortress guarded by millionaires. It’s a dynamic, rewarding playground where patience, creativity, and smart strategies pay off. Whether you’re starting with no money, leveraging your skills, or investing in a real estate investment trust, the road to building an impressive investment portfolio is yours for the taking.

Remember, every big empire started with a single brick. Take that step today, learn as you go, and watch how real estate can transform your financial landscape. Got your own investing stories or tips? Drop ’em below — I’d love to hear what’s worked for you or questions you’re wrestling with.

Freqeuntly asked Questions

how to invest in real estate with no money

You can start by wholesaling properties, using seller financing, or partnering with investors who provide the capital while you bring the deal.

real estate investing for beginners with no money

Beginners can explore house hacking, lease options, or real estate syndications where minimal or no upfront money is needed.

real estate investing app

Popular apps like Fundrise, Roofstock, and RealtyMogul let you invest in real estate online, often with low minimum investments.

real estate investment examples

Examples include rental properties, REITs, fix-and-flip houses, vacation rentals, and crowdfunding platforms.

how to invest in real estate for passive income

You can earn passive income through rental properties, REITs, or investing in real estate funds that pay regular dividends.

real estate basics for beginners

Start by learning about property types, financing methods, market research, and common investment strategies like buy-and-hold.

real estate investment trust

A REIT is a company that owns or finances income-producing real estate, and you can invest in it like a stock to earn dividends.

real estate investing

Real estate investing involves buying, managing, or financing properties to generate income or profit from appreciation over time.